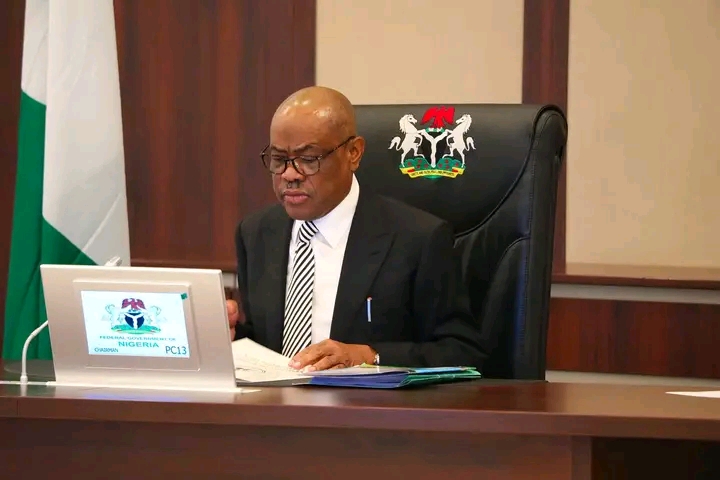

Abia State refutes claims of harsh taxation, highlighting transparent reforms, digital payments, and people-first policies to boost growth.

The Abia State Government has reaffirmed its commitment to fair taxation, transparent governance, and citizen-friendly reforms, countering recent claims of “draconian taxation” and “ruthless enforcement.” According to a statement signed by Emmanuel Okpechi, Ph.D, FCA, Special Adviser to the Governor on Internally Generated Revenue (IGR), the allegations are false and misrepresent the ongoing reforms under Governor Alex Otti, OFR.

Streamlined Enforcement and an End to Touting

Since taking office, Governor Otti has prioritised ending years of harassment and multiple levies. A three-month moratorium on daily collections was introduced, leading to the launch of a unified Harmonised Task Force. This approach has eliminated multiple tickets, reduced extortion, and enhanced public confidence.

Treasury Single Account (TSA) for Accountability

Abia now runs a Treasury Single Account (TSA), ensuring all government revenues flow into one account. This model improves cash management, enables real-time reconciliation, plugs financial leakages, and promotes full transparency.

Ease of Doing Business and Centralised Billing

To prevent multiple taxation, revenue collection is centralised under the Board of Internal Revenue (BIR). Citizens and businesses can now access consolidated demand notices and electronic receipts via AbiaPay, banks, PoS, card transfers, or USSD. An Ease of Doing Business Council has been established to make the state more predictable and attractive for investors.

Moderate Rate Reviews Aligned With Regional Benchmarks

Following extensive consultations, the government has implemented modest and competitive rate reviews. For example, the daily e-ticket for tricycle operators is set at ₦500—below many regional rates and without extra loading bay charges previously collected by non-state actors.

Refuting False Claims About Filling Stations

The government categorically denies the claim that filling stations are being charged ₦450 million in fees. Such levies do not exist in Abia’s approved schedules and are “bogus and illogical.”

Cash-Lite Digital Payment System

Abia operates a cash-lite regime, encouraging payments only through approved channels such as AbiaPay, banks, and authorised PoS systems. Every transaction generates an official e-receipt, ensuring traceability and reducing leakages.

Professional Partnerships, Not Percentage Cuts

The State Government clarified that its partnership with Access Bank is purely for strengthening financial technology and processes. No agreement grants the bank a 15% cut of collections. Instead, Abia’s ambitious ₦120 billion IGR target for 2025 relies on a broader tax base and pro-business reforms, not punitive rates.

Tax as a Shared Responsibility

Governor Otti’s administration sees tax as a fair contribution towards better infrastructure, healthcare, security, and market development. Citizens are already seeing tangible improvements and responding by paying lawful taxes through approved platforms.

ALSO READ: How to Get a Nigerian Tax ID Before Jan. Deadline for Bank Account Holders

How Citizens Can Participate

- Register for ABSSIN: Broaden the tax base and keep rates fair. Enrol here: https://abiapay.com/create-abssin.

- Pay Through Approved Channels: Always request an e-receipt.

- Report Irregularities: Notify the BIR or the Harmonised Task Force about touting, unofficial tickets, or cash demands.

The Abia State Government remains steadfast in its mission to foster fairness, transparency, and growth—building a stronger, people-oriented economy for all.

![BREAKING: Aba Business Leaders Fund Security Trust as Tinubu to Commission Port Harcourt Road [See Date]](https://nationscuriosity.com/wp-content/uploads/2025/09/20250905105321_-1284098773_5595677702454900473_640_396_85_webp-640x375.png)