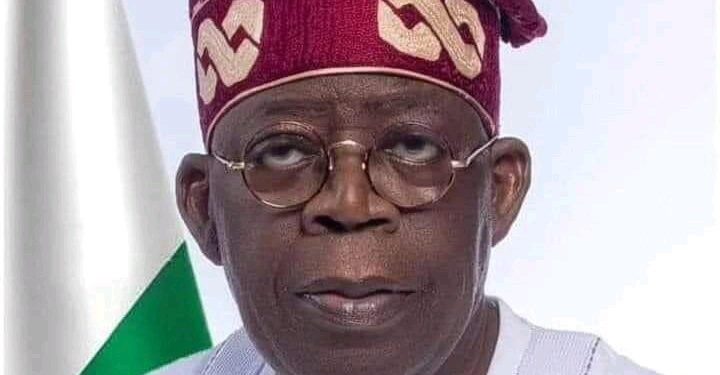

The Bola Ahmed Tinubu administration has put Nigeria in huge debt as it has borrowed nearly N96 trillion in two years, sending shockwaves among citizens. He has submitted proposals at the National Assembly to borrow nearly N39 trillion from multilateral agencies in one fell swoop, taking the nation’s debt profile to nearly N183 trillion.

On Tuesday, Mr Tinubu sought the approval of Nigeria’s lawmakers to borrow $21.5 billion, €2.2 billion, and ¥15 billion. He also plans to take a grant totalling €65 million. Mr Tinubu also asked the National Assembly to sanction the issuance of domestic bonds worth N757.9 billion to settle outstanding pension liabilities.

Mr Tinubu said he was borrowing to fix “significant infrastructure deficit in the country,” noting that there was paucity of financial resources needed to address the gap in the face of a declining domestic demand. He said it had become essential to pursue prudent economic borrowing to close the financial shortfall.

Mr Tinubu further said that the borrowing was aimed at generating jobs, promoting skills acquisition, fostering entrepreneurship, reducing poverty and driving food security, while improving the livelihoods of Nigerians.

Tinubu’s debt is rising fast

Mr Tinubu’s debt is rising very fast. Economy Post reported last month that the president had borrowed N56.6 trillion in just 23 months. With the new N39 trillion planned by Mr Tinubu, the administration has now borrowed nearly N96 trillion in 2 years. Under President Tinubu, Nigeria’s public debt has jumped from N87.4 trillion as at June 2023 (one month after Mr Buhari’s exit from power) to nearly N183 trillion. The debt reached N144.67 trillion ($94.23 billion) in December 2024.

Mr Tinubu’s loans are now more than double of former President Muhammadu Buhari’s debt which stood at N75.26 trillion in the whole of 8 years. It is now the highest since 1999.

Naira devaluation impact

However, while Mr Tinubu’s debt has been monumental, the effect of naira devaluation cannot be ignored. President Tinubu has taken some external loans from the World Bank, the African Development Bank (AfDB) and other multilateral financial institutions. But that is at a time the naira exchange rate has weakened against other major currencies.