The Federal Government of Nigeria has announced a sweeping tax reform that will affect millions of citizens and businesses across the country. Starting January 1, 2026, possession of a Taxpayer Identification Number (Tax ID) will become compulsory for all taxable Nigerians, corporate entities, and even non-resident companies offering goods or services in the country.

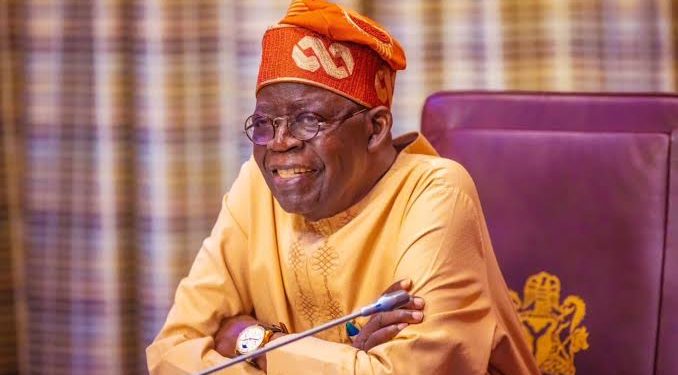

The directive is contained in the newly signed Nigeria Tax Administration Act, 2025, endorsed by President Bola Tinubu. According to the government, the legislation is designed to modernize Nigeria’s tax system, expand the tax base, and significantly boost revenue generation.

What the Law Says

Under Part II, Section 4, every taxable individual and business must register with the appropriate tax authority and obtain a Taxpayer Identification Card. This requirement cuts across all levels of government—federal, state, and local.

Additionally, Section 6 (1) extends the rule to non-resident individuals and companies providing taxable goods or services in Nigeria, mandating them to also secure a Tax ID.

ALSO READ: BREAKING: Outrage as Covenant University Bans Students From Cooking and Owning Phones [Why]

The law further empowers tax authorities, under Section 7 (3), to automatically issue Tax IDs to those who fail to apply, or deny applications where discrepancies exist. In cases of rejection, applicants must be informed within five working days.

Tax ID as a Prerequisite for Financial Services

Once enforced, a Tax ID will be mandatory for:

Opening or maintaining bank accounts

Accessing insurance, loans, and stock market participation

Bidding for federal and state government contracts

Conducting major financial transactions

This move ties tax compliance directly to financial and economic participation, signaling a major shift in Nigeria’s fiscal policy.

Provisions for Businesses Closing Operations

The Act also provides mechanisms for businesses winding down operations. Companies can either request a temporary suspension (dormant status) or a full deregistration of their Tax ID, provided they notify the tax authority within 30 days of closure.

Why This Matters

With this reform, the government is set to tighten revenue leakages, enforce accountability, and bring more Nigerians and companies into the tax net. Experts predict that this policy could transform Nigeria’s revenue collection, though it may also place additional compliance burdens on businesses and individuals.