The Joint Revenue Board (JRB) has officially abolished all road stickers across Nigeria and called for the immediate removal of illegal roadblocks used for unauthorized tax and levy collection.

The decision was announced in a communiqué issued after the Board’s 158th meeting held on December 9–10 at the Transcorp Hilton, Abuja. The JRB said the move is part of broader efforts to sanitize the nation’s revenue system and support ongoing federal tax reforms.

The Board praised the Federal Government’s fiscal and tax reform initiatives, noting that they are critical to boosting revenue generation, improving economic competitiveness, enhancing ease of doing business, and ensuring fiscal sustainability nationwide.

Welcoming the transition from the Joint Tax Board to the Joint Revenue Board, the JRB described it as a major step toward a more coordinated and efficient national revenue administration. The new framework is expected to strengthen collaboration among revenue authorities, improve data sharing, and enhance tax compliance.

The JRB emphasized that modern tax administration depends on accurate and interoperable data, resolving to strengthen data-sharing mechanisms and deploy analytics tools to harmonize revenue practices across all levels of government.

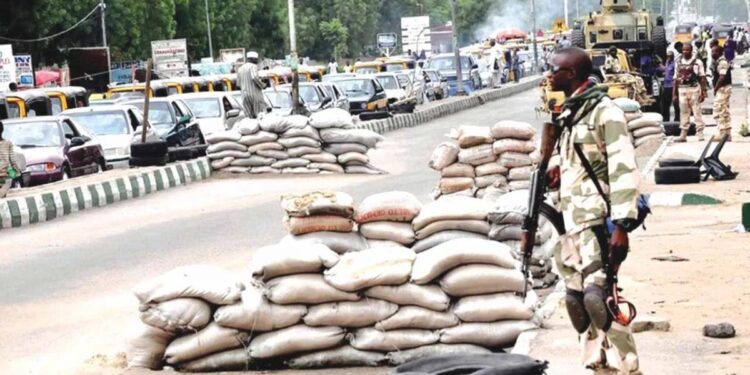

In a strong warning, the Board restated its commitment to eliminating non-state actors involved in illegal revenue collection. It urged the Office of the National Security Adviser, the Nigeria Police Force, and other security agencies to dismantle illegal roadblocks mounted along transport corridors for unauthorized collection of taxes and levies.

The Board also reaffirmed the total abolition of the design, production, issuance, and enforcement of all road stickers, urging Nigerians to resist such demands and report offenders to security agencies for appropriate sanctions.

ALSO READ: Ohuhu Records Successful Novelty Football Match Sponsored by Chief Uchechukwu Udeji (Nwa Ghana)

Additionally, the JRB called on state governments to fast-track the passage of the Harmonized Taxes and Levies (Approved List for Collection) Bill, to ensure uniform application of taxes and levies in line with national tax reform objectives.