Nigeria records ₦20.6 trillion revenue in eight months, up 40.5%, driven by non-oil gains and reforms, according to the presidency.

Nigeria generated ₦20.6 trillion in revenue between January and August 2025, representing a 40.5 percent increase from the ₦14.6 trillion recorded in the same period last year.

The presidency disclosed this in a statement signed on Wednesday by Bayo Onanuga, Special Adviser to the President on Information and Strategy.

According to the statement, the growth marks the country’s strongest fiscal performance in recent history, driven by record non-oil earnings which now account for three out of every four naira collected by the government.

Reforms Driving Growth

The presidency credited the increase to reforms aimed at tightening compliance, broadening the tax base, and digitising collections.

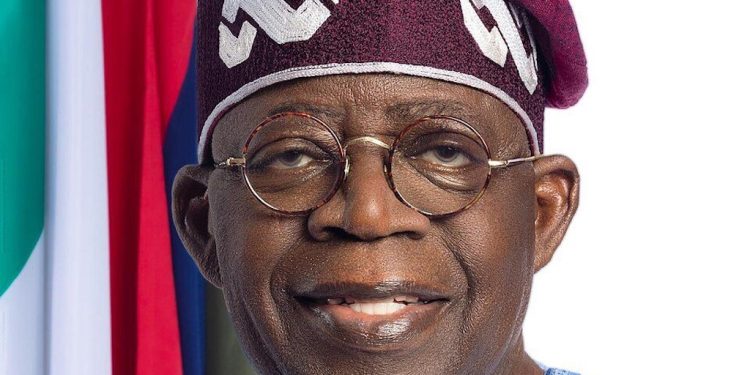

President Bola Ahmed Tinubu, speaking while receiving a delegation of the Buhari Organisation led by Senator Tanko Al-Makura, said the revenue performance was evidence that government reforms are working.

ALSO READ: BREAKING: China Makes History by Reversing Diabetes with Stem Cell Therapy

He also revealed that the federal government has not borrowed from local banks this year due to stronger inflows but admitted that revenues remain insufficient to cover projected spending on education, health, and infrastructure.

Breakdown of Collections

Non-oil receipts amounted to ₦15.7 trillion in the eight-month period, while oil revenues fell short amid lower global crude prices.

The Nigeria Customs Service exceeded expectations, collecting ₦3.68 trillion in the first half of the year, surpassing its target by ₦390 billion and achieving 56 percent of its full-year goal.

The improved inflows led to record allocations to states and local governments. In July, monthly disbursements from the Federation Account crossed ₦2 trillion for the first time, giving subnational governments additional fiscal capacity for food security, infrastructure, and social programmes.

Shift from Oil Dependence

The presidency noted that for the first time in decades, oil revenues are no longer the dominant source of government income.

It explained that while inflation and exchange-rate revaluation contributed to higher collections, the growth was mainly reform-driven through customs automation, digitised tax filings, and stricter enforcement.

The Budget Office is expected to validate the figures at the end of the year.