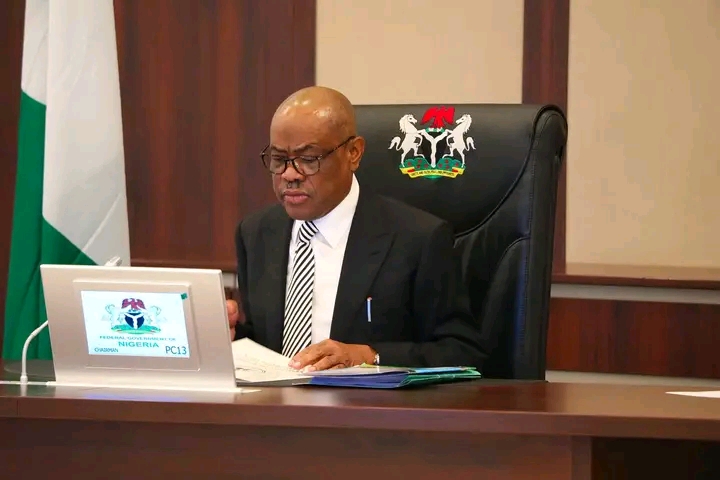

CBN Governor Cardoso drops bombshell: lending rates may fall soon as inflation eases, sparking hope for cheaper loans and stronger investments.

In a dramatic turn that could reshape Nigeria’s economic landscape, the Governor of the Central Bank of Nigeria (CBN), Mr. Olayemi Cardoso, has dropped a major hint — lending rates may soon fall as inflation continues to ease.

The signal has sent shockwaves through financial circles, fueling expectations of cheaper loans, stronger investment inflows, and renewed business confidence. For millions of Nigerians and enterprises battling high borrowing costs, this could be the long-awaited lifeline.

Cardoso emphasized that with inflation showing steady signs of cooling, the apex bank may finally be in a position to ease monetary policy. Analysts predict that such a move would unlock credit access, reduce business strain, and ignite new waves of economic expansion.

For years, sky-high lending rates have strangled businesses and weighed heavily on household finances. A possible reversal now holds the promise of breaking that cycle, giving entrepreneurs, investors, and consumers the breathing space needed to thrive.

ALSO READ: JUST IN: State Governor Swears In 17 Commissioners

Still, financial experts warn that the CBN will proceed cautiously, as sustained inflation stability remains key before any sweeping rate cuts are announced.

If realized, the looming rate slash could mark a historic shift — a decisive moment that redefines Nigeria’s economic trajectory and strengthens investor confidence at a critical time.